BSP reports digital payment transactions soar to 52.8% in 2023, surpassing targets amidst rising cybersecurity challenges; PSBank enhances mobile app for secure and personalized banking

At a glance

- Digital payment transactions in the Philippines increased to 52.8% in 2023, exceeding the BSP’s target of 50%.

- Cash usage has dropped to 87% in 2024, down from 96% in 2022, as more Filipinos prefer cashless payments.

- The rapid shift to digital banking has heightened concerns about cybersecurity, including threats like identity theft and phishing scams.

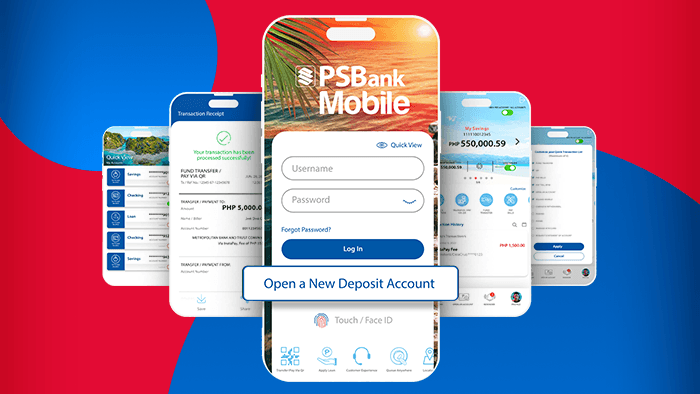

- PSBank has implemented enhanced security features, such as two-factor authentication, account monitoring, and ATM card lock/unlock options.

- The new PSBank Mobile app offers a more personalized and secure banking experience, with features like customizable interfaces and easy access to account and loan information.

Leave a Reply